Homeowners insurance in south carolina can protect you and your home from the cost of damage caused by certain hazards, like fires, theft, weather disasters, earthquakes and hurricanes. Prior to purchasing home insurance, it is important to know the exclusions and inclusions.

The homeownership process is not complete without obtaining a homeowners' insurance rate quote. Getting quotes from several companies can help you compare prices, coverages and discounts. You can get a discount by bundling your policy with other types of insurance, or installing security devices.

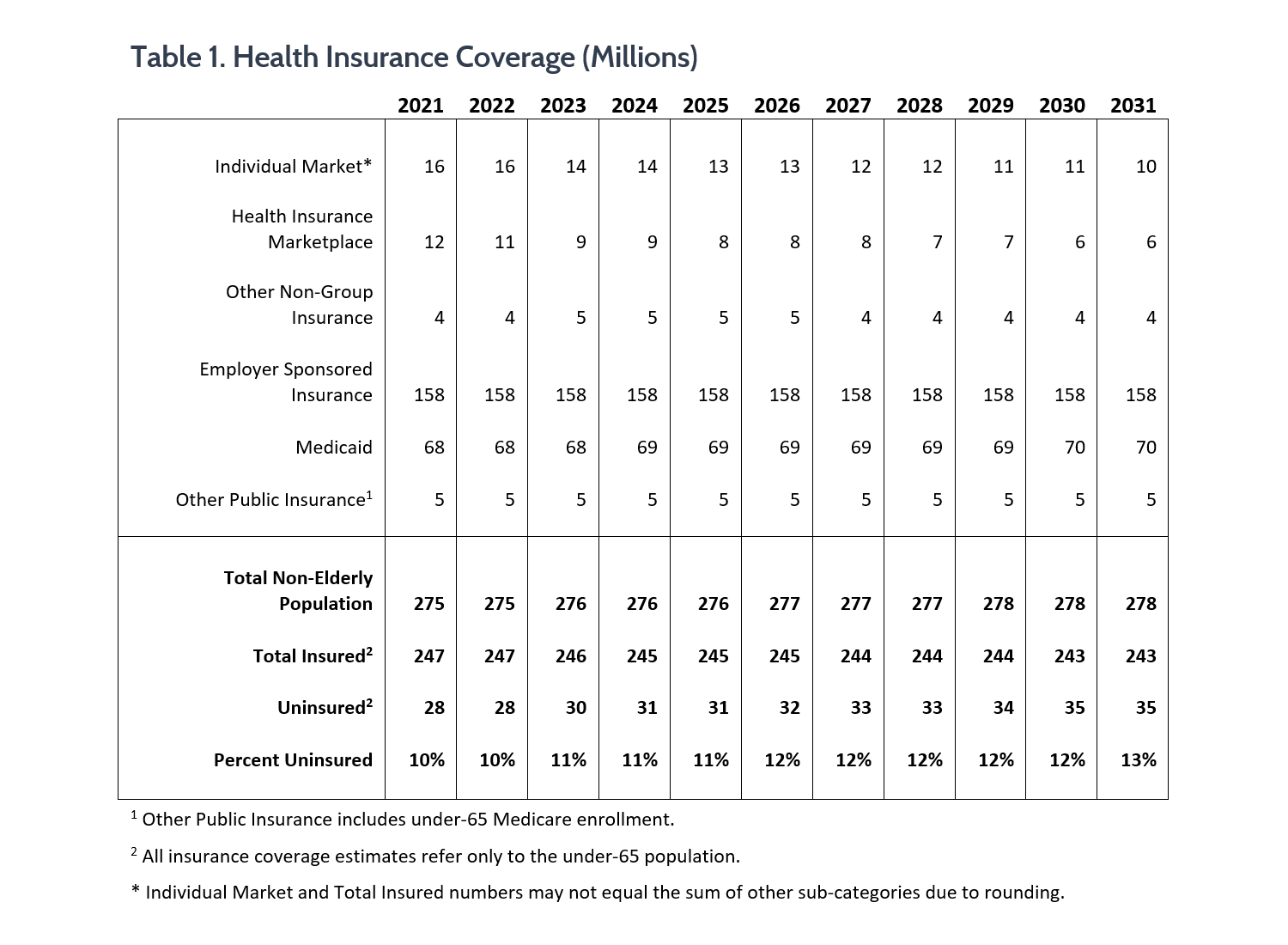

Allstate provides the cheapest insurance for home in South Carolina, offering an average rate of $990 per year. To reduce the cost, Allstate offers a deductible up to $1500.

If you live in a high-risk area, it might be worth considering buying flood insurance as an addition to your home insurance policy. This coverage is offered by many home insurers, but you should check with your agent to make sure that the level of protection provided will cover any weather-related disasters and floods.

Many of these policies include coverage for the rebuilding of your home as well as the replacement of your possessions. You may need to increase this amount if your collection includes expensive items. Some insurance companies offer an additional rider to cover living expenses such as laundry and restaurant meals if you are forced to leave your home due a covered loss.

Homeowners should make an informed decision when choosing the best home insurance company in South Carolina. A good provider should have a range of options as well as a high standard of customer service. Best companies have a good financial record and pay claims quickly and accurately.

Bankrate editors' expert analysis of a wide range of factors was used to determine the top homeowners insurance providers in South Carolina. These include average home premiums provided by Quadrant Information Services; coverage options; customer service ratings; and industry scores based on third-party sources.

The best home insurance in South Carolina should offer the right coverage at the right price and be easy to claim. This is true especially when you are filing a claims for something which is not covered in your standard homeowners policy.