It is crucial to be aware of what you are covered for and how much when shopping for renters' insurance. There are three main types of coverage available: personal property, liability and medical bills. Your choice of coverage will depend on what type of property is being covered and your budget. There are many companies that provide comprehensive coverage, which can help you avoid expensive surprises.

Allstate

Allstate renters' insurance is available in many states. This type of policy covers many things, including stolen or damaged personal items, as well as the costs of other people's injuries. Additional living expenses coverage is available to pay for meals out, pet boarding, and laundry. You can also file a claim via the company's mobile app.

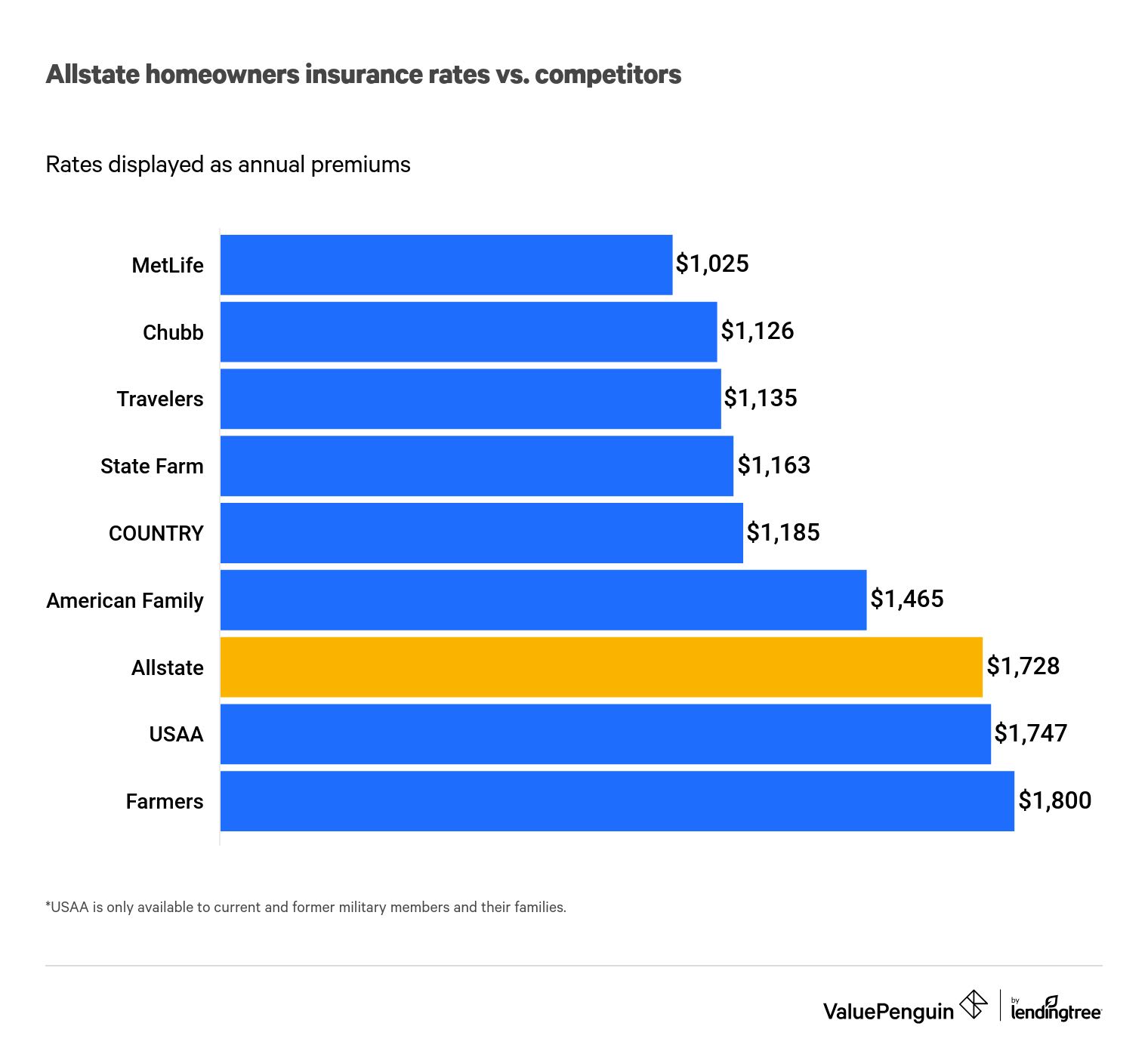

A typical Allstate renters' insurance policy costs about $120 a calendar year or approximately $10 per month. The rate depends on several factors, including location, credit history, and the amount of coverage you want. Also, consider your deductibles. They can have an impact on your overall cost. Obtaining multiple quotes can help you save money on insurance premiums.

USAA

USAA renters' insurance is one the most popular insurance policies for renters in America. It provides coverage for your home, personal property, and liability. It is also available to non-members. A single policy can cover up to 10 rental properties. If you rent a part of your primary residence, you can add home sharing coverage. Register as a Member, provide your Social Security number and basic personal information to get started.

USAA Renters Insurance is the best choice for veterans and military renters. This insurance plan offers discounts and exceptional customer service. You will be pleased to know that you have 24/7 access to exceptional customer support. The claims process is quick and easy. It is available online and over the phone. You can even use voice-guided tech if your eyes are impaired.

Liberty Mutual

Are you searching for renters insurance that is affordable? If you're looking for a company that offers national coverage, a customizable quote system, and competitive prices, Liberty Mutual may be the best choice for you. But there are a few things to be aware of before you choose a policy. For one, they don't reward you for being a loyal customer, so make sure you compare several quotes before you make a decision.

Liberty Mutual's quote tool can help you to compare deductibles as well as coverage options. You can enter basic information, such as your name, current and previous addresses, date of birth, and number of pets. You can also enter a few other details, such as your employment status and education. You can also get a discount for being an early shopper and pick a policy that fits within your budget.

Amica

Amica renters insurer offers a customizable plan that comes with many options. You can select upgrades to your standard coverage. The policy will cover the cost of replacing or repairing your personal property in the event of an accident. Other features include identity theft reimbursement and scheduled personal property coverage.

Amica has a high customer satisfaction rating. It has a low NAIC complaint index. This means that there are fewer complaints about the company than other home-insurance providers.